Ever wondered how people make money trading currencies? You’re not alone. According to the Bank for International Settlements, the forex market trades over $7.5 trillion daily as of 2022—making it the largest financial market in the world. If you’re curious but overwhelmed, you’re in the right place. This guide breaks down trading with forex for beginners into simple, actionable steps.

What is Trading with Forex for Beginners?

Forex (foreign exchange) trading is the process of exchanging one currency for another in hopes of profiting from changes in their relative values. It’s often done via online platforms using leverage, charts, and technical analysis.

Key Terms to Know:

-

Currency pair: Example: EUR/USD

-

Pip: Smallest price move in forex

-

Leverage: Borrowed capital to increase trade size

-

Lot size: The volume of trade

-

Spread: Difference between bid and ask prices

Why is Forex Trading Important?

Explosive Growth and Global Access

-

Accessible: You can start with as little as $50

-

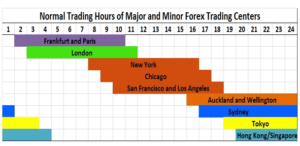

Open 24/5: Unlike the stock market, forex operates nearly around the clock

-

Highly liquid: Easy to enter and exit trades

“Forex trading offers a unique combination of high liquidity, 24-hour access, and low startup costs,” says Paul Rodriguez, financial analyst at FXCM.

How to Start Trading with Forex for Beginners

Step 1: Choose a Reputable Forex Broker

Look for:

-

Regulation: (e.g., FINRA, FCA, ASIC)

-

Low spreads and fees

-

Demo accounts for practice

➡️ For a deep dive into choosing brokers, check our training on Best Forex Brokers for Beginners.

Step 2: Open a Trading Account

-

Sign up on the broker’s platform

-

Verify your identity (KYC)

-

Click To Access Tap To Trade Deposit funds via bank, PayPal, or crypto

Step 3: Learn Forex Basics

-

Study chart patterns, candlesticks, and indicators like RSI and MACD

-

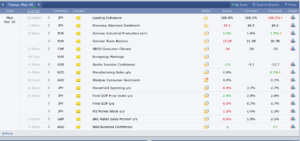

Understand economic news impact (e.g., interest rates, inflation)

Step 4: Practice with a Demo Account

Before risking real money, demo accounts simulate live markets without the stress.

Step 5: Start Small with a Strategy

Begin with micro-lots and a solid strategy:

-

Scalping – quick trades

-

Day trading – positions closed same day

-

Swing trading – hold for days/weeks

Benefits of Trading with Forex for Beginners

-

Low capital requirement

-

Flexible hours

-

Diverse trading options (pairs, exotic currencies)

-

Advanced tools & automation (MetaTrader 4/5, bots)

Common Mistakes to Avoid

❌ Overleveraging

Newbies often get burned using 100:1 leverage. Start low.

❌ Ignoring Risk Management

Set stop-loss and take-profit levels on every trade.

❌ Emotional Trading

Fear and greed kill more accounts than bad strategies.

❌ Neglecting a Trading Plan

Flying blind = guaranteed crash. Stick to a plan.

Forex Trading Strategies for Beginners

| Strategy | Timeframe | Skill Level | Risk |

|---|---|---|---|

| Scalping | 1–5 min | Intermediate | High |

| Day Trading | 15 min–1 hour | Beginner–Intermediate | Medium |

| Swing Trading | 4 hr–daily | Beginner | Low–Medium |

| Position Trading | Weekly–Monthly | Advanced | Low |

➡️ Want a breakdown of these strategies? Visit Best Forex Strategies for 2025.

FAQ: Voice Search Friendly

Can I trade forex with $100?

Yes, many brokers allow micro-lot trading starting at $100 or less.

Is forex trading legal?

In most countries, yes—as long as you’re using a licensed broker.

Is forex trading profitable for beginners?

It can be, but only with discipline, education, and risk management.

Do I need a license to trade forex?

Not for personal use. Only if you plan to trade others’ money professionally.

Forex vs Stock Trading: A Quick Comparison

| Feature | Forex | Stock Market |

|---|---|---|

| Market Hours | 24/5 | 9–5 (M–F) |

| Leverage | High (up to 500:1) | Low (2:1) |

| Volatility | High | Medium |

| Regulation | Global | National |

| Entry Barrier | Low | Medium |

Tools & Resources for Beginners

-

MetaTrader 4/5 – Industry-standard trading platforms

-

TradingView – Charting and community ideas

-

Babypips.com – Beginner education hub

-

Investing.com – Real-time economic calendar

-

MyFxBook – Track and analyze performance

Conclusion

Trading with forex for beginners isn’t a get-rich-quick scheme, but with the right tools and mindset, it can be a powerful way to build wealth. Start slow, practice diligently, and never stop learning.

💬 What’s holding you back from starting forex trading? Why hesitate, Start your adventure NOW!!