Mastering Forex Trading for Beginners

Forex (foreign exchange) trading offers thrilling opportunities to generate income, but it’s not without risks. Success requires a blend of knowledge, strategy, and discipline. This guide breaks down the essentials to help you navigate the market confidently—while keeping risks in check.

1. Master the Forex Basics

Start by understanding these core concepts:

- Currency Pairs: Forex involves trading currencies in pairs (e.g., EUR/USD). The first currency is the base, the second is the quote. The price reflects how much of the quote currency is needed to buy one unit of the base.

- Pips: The smallest price movement, typically the fourth decimal place (0.0001). For JPY pairs, it’s the second decimal (0.01). A 10-pip move in EUR/USD from 1.1000 to 1.1010 means the euro strengthened.

- Lots: Trade sizes. A standard lot = 100,000 units; mini = 10,000; micro = 1,000. Smaller lots reduce risk exposure.

- Leverage & Margin: Leverage (e.g., 1:100) lets you control larger positions with less capital. However, it magnifies both gains and losses. Margin is the collateral required to open a leveraged position. Overuse can trigger margin calls (forced closure of trades).

2. Choose a Regulated, Reputable Broker

Your broker is your gateway to the market. Prioritize:

- Regulation: Ensure oversight by bodies like the FCA (UK), ASIC (Australia), or CFTC (US). Regulation protects against fraud.

- Low Costs: Compare spreads (bid/ask difference) and commissions. Tight spreads save costs in frequent trading.

- Platform Quality: Test platforms like MetaTrader for user-friendliness, tools, and execution speed.

- Reviews: Check forums and Trustpilot for feedback on reliability and customer service.

3. Practice with a Demo Account

Demo accounts (with virtual funds) let you:

- Test strategies risk-free.

- Learn platform features (order types, charts).

- Simulate real-market conditions.

Pro Tip: Treat demo trading seriously—avoid reckless bets to build disciplined habits.

4. Leverage Wisely—Respect the Risks

While 1:500 leverage sounds tempting, it’s a double-edged sword. Example:

- A 100 account with 1:100 leverage = 10,000 position.

- A 1% price move against you = 100% loss.

Rule of Thumb: Start with lower leverage (1:10–1:30) and increase only as you gain experience.

5. Know Your Currency Pairs

- Majors: Highly liquid (e.g., EUR/USD, USD/JPY). Tight spreads, stable trends.

- Minors (Crosses): Exclude USD (e.g., EUR/GBP). Slightly wider spreads.

- Exotics: Pair a major with an emerging economy (e.g., USD/TRY). Volatile, illiquid, and prone to geopolitical risks.

6. Time Your Trades with Market Sessions

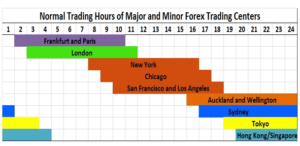

Forex operates 24/5 across four sessions:

Sydney (5 PM–2 AM EST): Quiet, often range-bound.

Sydney (5 PM–2 AM EST): Quiet, often range-bound.- Tokyo (7 PM–4 AM EST): Watch for JPY movements.

- London (3 AM–12 PM EST): Highest liquidity (35% of volume). Ideal for EUR/GBP.

- New York (8 AM–5 PM EST): Overlaps with London, causing volatility (e.g., USD pairs).

Tip: Trade during overlaps (e.g., London-New York) for maximum opportunity.

7. Track Economic Indicators

Fundamental analysis drives long-term trends. Key indicators:

- Interest Rates: Higher rates attract foreign capital, boosting currency value.

- GDP: Measures economic health. Rising GDP = stronger currency.

- CPI/Inflation: High inflation may lead to rate hikes.

- Employment Data (e.g., U.S. NFP): Strong job growth signals economic strength.

8. Decode Central Bank Policies

Central banks (Fed, ECB, BoJ) shape currencies through:

- Interest Rate Decisions: The #1 market-mover.

- Quantitative Easing (QE): Increases money supply, weakening currency.

- Forward Guidance: Clues on future policy.

Example: If the Fed hints at rate hikes, USD often rallies.

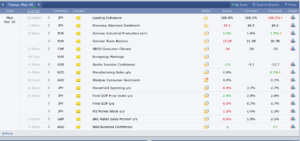

9. Stay Ahead with an Economic Calendar

Plan trades around high-impact events:

- Central bank meetings.

- Employment reports.

- Geopolitical developments (elections, trade wars).

Pro Tip: Avoid holding risky positions during major news unless you’re scalping.

10. Minimize Costs with Tight Spreads

- Bid Price: What buyers pay.

- Ask Price: What sellers receive.

- Spread: The broker’s fee. EUR/USD often has 0.1–1 pip spreads; exotics can exceed 50 pips.

Final Tips for Success

- Risk Management: Never risk >1–2% of capital per trade. Use stop-loss orders.

- Learn Continuously: Explore technical analysis (charts, indicators) and trading psychology (avoid FOMO).

- Start Small: Scale up as you refine strategies.

Forex trading isn’t a get-rich-quick scheme. Patience and education separate lasting traders from short-lived gamblers. Stay curious, stay cautious, and let discipline guide your journey.

Happy Trading! 🚀

Bonus: Bookmark these resources:

- Forex Factory Economic Calendar

- Babypips School (free forex courses)

- TradingView (charting tools)

- Akashx (trading education and scanners)

- TradeXmastery (prop firms – trade with other peoples money)

Leave a Reply